Yesterday’s Reuters dispatch from the U.S. manufacturing floor revealed a fascinating, if unsettling, economic paradox. While the sector broadly slogged through its sixth consecutive month of contraction in August, specific factories found themselves in an unexpected growth spurt. The common denominator? Aggressive investment in artificial intelligence.

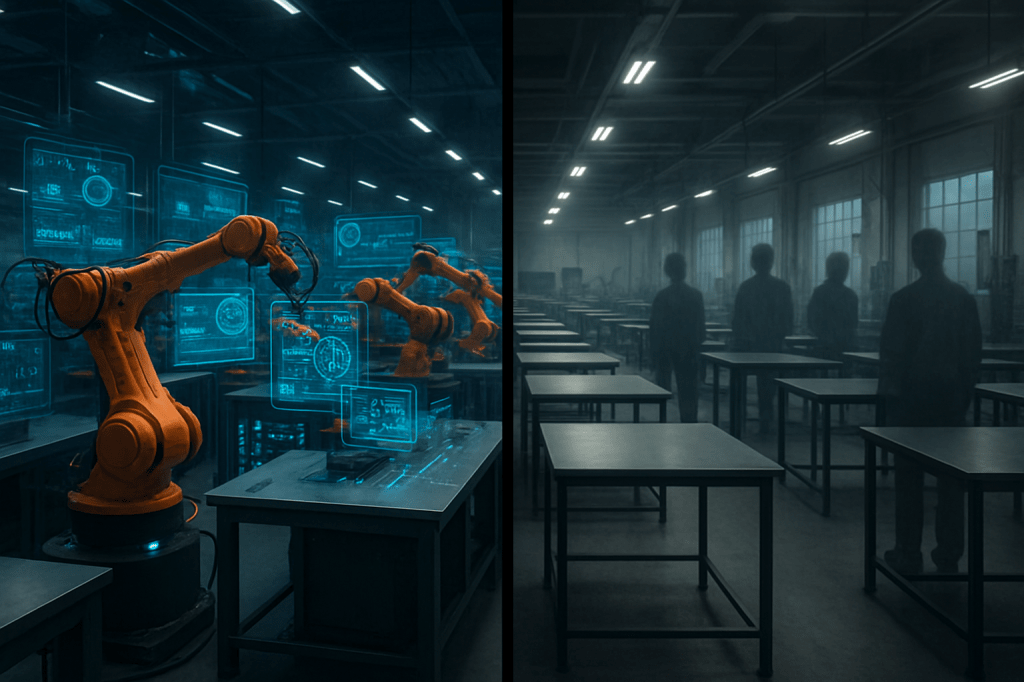

The Bifurcated Reality of Industrial Decline

The headline numbers from the Institute for Supply Management (ISM) painted a familiar picture of weakness, with the manufacturing PMI landing at 48.7. Yet, beneath this aggregate slump, a powerful undercurrent is reshaping the industrial landscape. The second quarter witnessed the fastest growth in intellectual property spending in four years, a surge directly attributed to AI investments. This isn’t just about adopting new tech; it’s about a strategic re-orientation, creating islands of AI-fueled expansion within a sea of overall decline.

Economists are already anticipating this AI-related spending to continue its upward trajectory, further buoyed by the current administration’s tax and spending initiatives. The implication is clear: capital is flowing not into generalized expansion, but into targeted, AI-driven transformation, betting on efficiency and automation as the path to future competitiveness.

Efficiency Gains, Human Costs

Here’s where the “AI Replaced Me” narrative sharpens its focus. Despite these significant investments and localized growth, overall production dipped to 47.8, and job cuts are not only ongoing but accelerating. This isn’t a simple case of a struggling sector shedding jobs due to weak demand; it’s a more complex scenario where investment in advanced capabilities is happening concurrently with, and likely contributing to, the reduction of human labor.

- The AI-fueled growth pockets are demonstrably capital-intensive, not labor-intensive.

- The efficiency gains from AI are allowing some factories to do more (or the same) with fewer people, even as overall demand remains soft.

- This suggests a fundamental shift in the economic structure of manufacturing, where the pathway to solvency and growth increasingly bypasses traditional employment models.

The Unseen Ripple: From Factory Floor to Consumer Wallet

The story doesn’t end with job displacement. The report also highlighted a slight increase in supplier delivery times, a subtle but significant indicator that pushed up input prices. Companies are now beginning to absorb these rising costs, and the expectation is stark: these will be passed on to consumers in the coming months. This adds another layer of complexity to the AI equation. If AI investment is driving efficiency but not necessarily lowering overall production costs (due to other supply chain pressures) or if it’s concentrating market power, we could be looking at a future where the gains of automation are realized by a few, while the costs – both in jobs and higher prices – are borne by many.

This isn’t just a quarterly economic update. It’s a real-time illustration of how AI is not merely disrupting, but actively restructuring entire industries, creating a deeply uneven economic landscape where the future of work is being redefined at an accelerating pace. The question is no longer *if* AI will replace roles, but *how* its selective, efficiency-driven growth will reshape the very fabric of our economy and daily lives.