Lighthouse on Lake Michigan: When AI Puts On a Hard Hat

Port Washington, Wisconsin woke up yesterday to a future that doesn’t arrive in an app store. OpenAI, Oracle, and Vantage Data Centers said they will plant a near‑gigawatt AI campus on the shoreline and call it Lighthouse. It’s a fitting name: designed to illuminate the larger Stargate build‑out sweeping the United States, and to signal something many still miss about this moment in AI. The next phase isn’t just code. It’s cranes, switchgear, and union hall rosters filling up before dawn.

The headline numbers are unusually concrete for an AI story. More than 4,000 skilled, mostly union construction jobs over multiple years, and over 1,000 permanent roles once the site is operating. Local reporting breaks that down into roughly 330 operations jobs attached to Vantage’s side of the campus and about 700 roles tied to OpenAI and Oracle on site. Add the spillovers—caterers, logistics, fiber installers, substation crews, replacement parts, housing—and the employment picture starts to look like what heavy industry used to mean for a region. The investment figure, more than $15 billion for Vantage’s portion alone, underscores the capital intensity required to turn AI from hype into hardware.

AI’s labor story, inverted

For the past two years, the jobs narrative around machine intelligence has been dominated by the spreadsheet: reorgs, role consolidations, efficiency drives. Lighthouse flips the frame. It’s immediate job creation across trades that rarely trend on tech Twitter—civil, electrical, mechanical, controls—plus the long‑term, high‑skill operations work that keeps a hyperscale campus breathing 24/7. If you’ve been tracking AI’s displacement risk for analysts, paralegals, and copywriters, Lighthouse is the counterweight: evidence that demand for tokens translates, via physics and grid interconnections, into demand for people who build and run energy‑dense facilities.

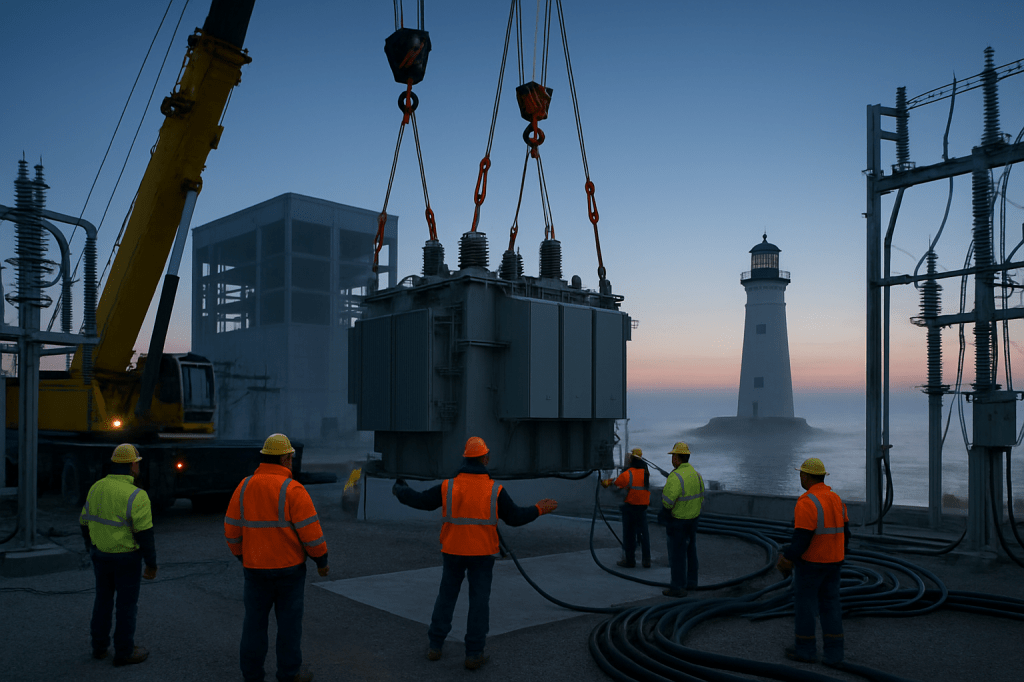

That density matters. A campus “close to a gigawatt” compresses an enormous amount of economic activity into a tight radius. Every megawatt pulled through a new substation implies design reviews, transformers, protective relays, medium‑voltage cable pulls, and commissioning teams. Cooling implies mechanical builds, water or refrigerant system expertise, and environmental monitoring. These aren’t ephemeral roles. They’re the backbone of uptime, and they tend to be stubbornly local.

Why Wisconsin, why now

Reuters framed Lighthouse as one node in a multi‑site strategy under the Stargate banner—10+ gigawatts of capacity across the U.S., with Wisconsin following earlier sites like Abilene, Texas. Look past the brand name and the pattern becomes clear. To keep U.S. leadership in AI, the industry is assembling an industrial footprint that looks less like a Silicon Valley campus and more like a distributed power utility stitched to high‑performance computing. Sites like Port Washington sit at the intersection of transmission corridors, water access, temperate climate, logistics, and a skilled labor pool with union depth. You choose those coordinates when you’re optimizing for time‑to‑power, not just time‑to‑market.

The schedule tells its own story. Construction is slated to begin quickly, with phased operations before the 2028 completion target. Translation: the heaviest lift in hiring begins over the next 24 to 36 months. Apprenticeship programs will stretch to fill demand; contractors will shuffle crews across regions to close gaps; wage pressure will ripple through specialized trades. By the time the first buildings flip from construction to commissioning to production, a second wave of permanent headcount follows—facilities engineers, network techs, security, data center operations—roles that blend software instincts with industrial reliability.

The multiplier that doesn’t show up in a model

Numbers can understate what happens when an AI campus lands. A project of this size remaps local supply chains. Steel and concrete pour first, but then come chillers, generators, battery systems, fiber backbones, and high‑voltage gear with global lead times. Regional service businesses adapt around the predictable cadence of a multi‑year build, and then tack to the equally predictable rhythm of maintenance windows and upgrade cycles. Seen from space, this is “AI as infrastructure.” On the ground, it is a new, durable employer that coordinates hundreds of small economies around its uptime targets.

There’s also the quiet skills arbitrage. Hyperscale operations increasingly resemble air traffic control: you need people who can switch between electrical one‑line diagrams, software dashboards, and incident playbooks without blinking. Those jobs are sticky. Once that workforce assembles in a region, it becomes the seed crystal for the next facility—and a moat for the ones already there.

Union jobs in the AI era

One of the least discussed features of the AI boom is that it’s inadvertently reviving segments of organized labor through data center construction. Lighthouse leans into that. For all the ink spilled on AI automating office work, this is a rare part of the AI stack where labor and capital aren’t mostly substitutes—they’re complements. You can’t prefab your way out of every constraint when you’re threading new transmission capacity, commissioning protective systems, or chasing PUE improvements at scale. That gives trades bargaining power and gives local governments leverage to tie training and community benefits into permitting. If AI is reshaping work, union construction is reshaping AI’s footprint.

The tests ahead

None of this is frictionless. A near‑gigawatt campus is a grid customer first, a compute provider second. The timing of interconnections, the availability of clean power, and the political optics of who gets priority during tight periods will all matter. Housing pressure around construction peaks can strain communities not used to cyclical influxes of workers. And while operations roles are permanent, they are not immune to automation pressure inside the data center itself; the long‑term employment curve will be shaped by how far instrumentation and AI‑assisted facility management compress headcount per megawatt.

But in the near term, the risks are execution risks, not demand risks. The capital is committed, the partners are aligned, and the industry’s appetite for compute is still outrunning its ability to deliver power and floorspace. If anything, Lighthouse’s schedule signals that the chokepoint isn’t GPUs; it’s the pace at which the physical economy can add capacity safely and reliably.

The takeaway

Yesterday’s most consequential AI‑employment story wasn’t a forecast or a layoff memo. It was a build. Lighthouse is proof that the AI boom now hires by the thousands in places where the internet used to be something you consumed, not something you constructed. Over the next three years, the action in Port Washington will look less like a revolution and more like a routine: shift changes, safety talks, crane picks, commissioning checklists. That routine is what converts abstract demand for intelligence into durable jobs—and it’s how U.S. AI leadership will be measured, one intertie and one headcount at a time.