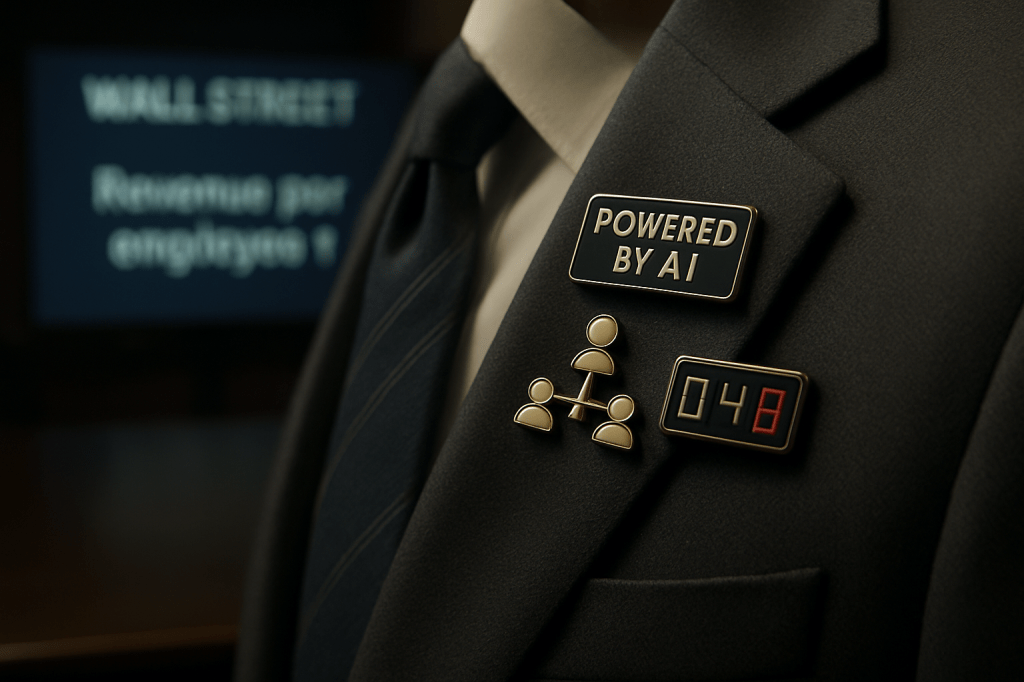

The new merit badge on Wall Street’s blazer: layoffs, stamped “Powered by AI”

Some shifts happen with a single announcement. This one arrived as a chorus. Over two weeks, blue-chip leaders stepped to microphones and quietly rearranged the moral geometry of corporate decision-making: job cuts were no longer a symptom of weakness—they were proof that the company had the courage to implement AI at scale. With every earnings call that married a shiny automation roadmap to a headcount reduction, the applause got louder, and a new message settled in: in 2025, efficiency isn’t just the result of good management. It is the performance.

From euphemism to declaration

For most of the year, executives favored comfort language. AI would augment, not replace. Internal memos promised new roles as old ones evolved. Then the framing turned crisp. Amazon’s Andy Jassy had already laid the groundwork, telling employees and investors that broad adoption would mean fewer people in some job families as productivity rises. That sentence, once controversial, is now a template. This month, leaders across sectors didn’t hedge; they credited AI directly as the reason they could do more with fewer corporate roles, and they implied that waiting would be the irresponsible choice.

The pattern that stopped looking like coincidence

Timing did the heavy lifting. Amazon disclosed thousands of corporate cuts. Target trimmed corporate ranks. UPS tallied tens of thousands of reductions across the year. Verizon signaled a large plan, and Nestlé mapped out multi-year thinning. These weren’t scattered decisions, and they didn’t read like defensive maneuvers against soft demand. They landed in late October and early November, right after data showed the highest October layoff notices in more than two decades. Once clustered, the reductions formed a narrative: AI-linked restructuring had moved from slideware to headcount.

Layoffs as a signaling device

Here’s the novelty Fortune surfaced: the act of cutting jobs—when explicitly framed as AI-enabled—has become a way to project managerial discipline. Investors have been rewarding early movers, not for austerity in the abstract, but for an operational stance that says, “We have found real, automatable work, and we are not waiting.” The economics are familiar; the communication strategy is new. Announcements increasingly pair an automation milestone with a “re-architecting” update, making headcount the tangible proof that software is actually delivering savings. In the background, a new scoreboard is emerging. Revenue per employee becomes the public metric, and a lower corporate headcount is not a side effect—it’s the emblem.

Where the blade lands first

The initial impact zone is not factory floors; it’s desks. Logistics and telecom operations are being rewired, but the sharpest reductions are in white-collar corporate functions—support, finance and operations, and the managerial layers that sit between strategy and execution. Generative systems are swallowing templated communications, routine analysis, and forecast-to-report cycles. That shifts the span of control. A single manager can supervise larger teams because AI handles the base work and the status layer. The org chart becomes thinner in the middle before it gets shorter at the top.

The flywheel risk

Once the market treats AI-linked layoffs as evidence of competence, the incentive is to find more. Boards see peers rewarded for early action. CFOs are asked, on the next call, to show incremental “hard savings” as pilots move into production. The danger is overshoot. AI’s productivity can be real and discontinuous, but not every role is modular, and not every process shrinks cleanly when a system takes 30% of the work. Companies that compress too quickly will rediscover failure modes we’ve seen before: customer experiences that look polished on slides and brittle in the wild, knowledge that leaks as corporate memory walks out the door, and cost savings that quietly reappear as contractor spend.

The internal politics of automation

This shift also recasts governance. For years, CHROs argued for reskilling budgets while CFOs argued for margin expansion. AI’s new credibility strengthens the finance side of that tug-of-war. Severance is a line item with a date; reskilling is a promise with a question mark. The CEO’s posture breaks the tie. Today, the tie is breaking toward speed. The companies that square this circle will do it by pairing hard reductions with equally concrete pathways into AI-adjacent roles, not just a training portal and a town hall. The rest will backfill through “quiet hiring,” reintroducing complexity under different labels.

The next act is scheduled

If you want to know how far this goes, listen to earnings calls. Expect more explicit coupling of AI deployment milestones with workforce updates: chatbot containment rates next to headcount in customer support, close-process cycle times next to finance reductions, and new span-of-control targets next to middle-management cuts. The October spike in layoff notices looks like a first wave. The second arrives as pilots hit production in Q1 and Q2, when boards will ask to see the savings that the slides implied.

The line that moved

What changed yesterday wasn’t just the number of jobs at stake. It was the social meaning of cutting them. In the prior cycle, layoffs were framed as emergency triage or cyclical hygiene. This time, they’re presented as the visible signature of an AI-first operating model. That reframing is potent. It tells employees where the gravity is shifting, it tells investors how to grade leadership, and it tells competitors what competence looks like. The rhetoric crossed the river; the org charts are following.

For the people inside these companies, the signal is unambiguous. If your work product decomposes cleanly into steps an AI can learn, the burden of proof has inverted. You no longer need to show that AI can do your job. You need to show why your job should still exist once it can.