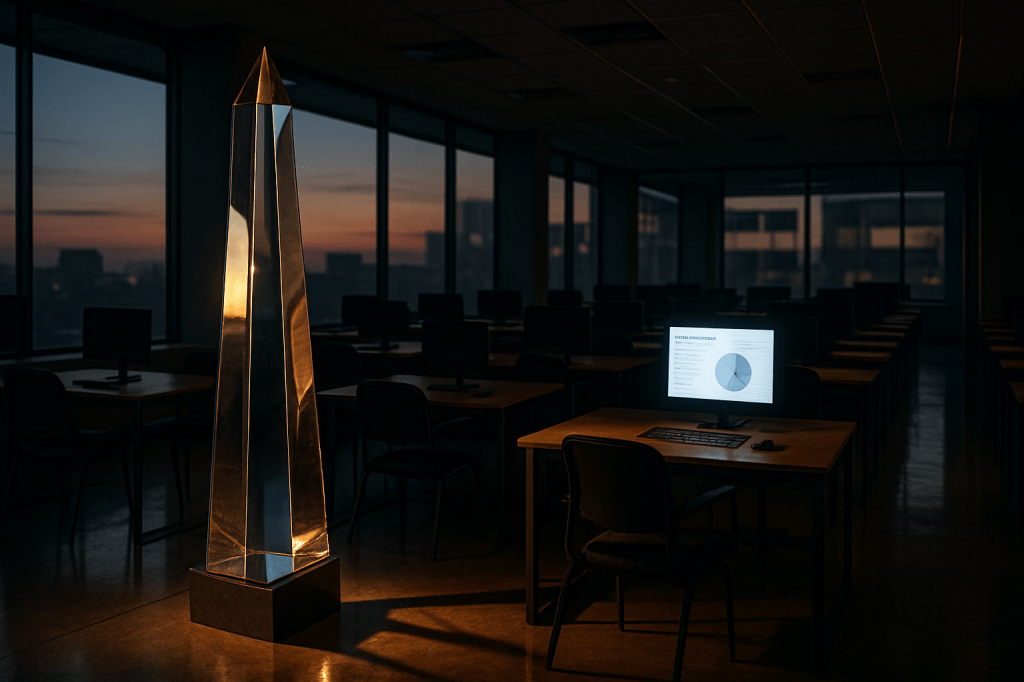

The day consulting’s pyramid stopped growing

Yesterday’s quietest number said the loudest thing: the starting salaries at McKinsey, Boston Consulting Group, and Bain are staying exactly where they’ve been—again—for 2026 start dates. Roughly $135,000 to $140,000 for undergraduates, $270,000 to $285,000 for MBAs. The Financial Times reported it’s the third year of flat offers at the top strategy firms, and the Big Four have been stuck since 2022. This isn’t about stinginess or a soft quarter. It’s a staffing blueprint, rewritten by software.

Consulting’s towering pyramid was built on a predictable physics. You hire a very large base of smart juniors, route the research, modeling, and deck-building through them, then filter up a small fraction while the rest spill into industry. That foundation is now poured by generative models and internal copilot systems that digest filings, reconcile datasets, run sensitivity cases, and draft slides without blinking. The FT ties the freeze directly to this shift, and the behavior matches the story: fewer graduate seats, more mid‑career hires who know a sector or a system deeply, and a subtle but steady requirement that every engagement be staffed with humans who can ride alongside the AI rather than replicate what it already does.

From pyramid to obelisk

Inside these firms, metaphors have become org charts. Executives are experimenting with shapes that aren’t the old base-heavy tower—an obelisk with a narrow bottom and high concentration of expertise, an hourglass with a slim middle and productized tooling beneath it, even a box with mostly flat layers and modular pods. Each shape assumes the same thing: the low-skill accumulation of hours has decoupled from value because machines can cheaply do the piling. The economic consequence is simple and brutal for early careers. When the foundation thins, the “up‑or‑out” path becomes “in‑if‑you‑already‑know,” and the apprenticeship that once came bundled with a name-brand offer is harder to access.

Freezing pay is less about this year’s margin and more about changing gravity. If the top of the market doesn’t move, everything below it anchors. In real terms, the purchasing power of those offers falls as inflation ticks on, a quiet signal that entry-level human throughput is no longer the binding constraint. The firms aren’t shy about the catalyst. Senior leaders quoted in coverage described AI putting downward pressure on junior hiring and costs, with clients now expecting proof that their advisors use the very tools they recommend. “Show me your own AI,” has become the new due diligence—credentialization not just of knowledge, but of operating model.

The new bargain

What replaces the analyst class is not empty space. It’s a different bargain: fewer seats for generalists, more weight on mid-career specialists who pair domain depth with systems fluency, and a growing internal market for people who can orchestrate models, data, and client context into repeatable products. PwC’s trimming of back‑office roles in the U.S. and McKinsey’s reductions in some IT positions, reported alongside the pay stagnation, read as the same playbook. Shrink the manual layers, retool workflows around AI-enabled productivity, and redeploy headcount where human judgment still multiplies outcomes rather than shadows a spreadsheet.

The downstream effects will ripple far beyond the partnerships. For two generations, consulting served as a finishing school that trained managers for the rest of the economy. If the intake stays small, the supply of that generalist talent into corporates tightens, and the training burden gets pushed somewhere else: in‑house academies, vendor ecosystems, or software itself. Universities will feel it first. MBAs, calculating a return on investment, will find fewer guaranteed on-ramps into brand-name firms and more pressure to arrive pre-specialized. Undergraduates who once banked on learning by doing may have to learn by product—working inside AI-driven tooling that supervises, grades, and accelerates them, but rarely sits across the table to explain why a client is really asking the question they asked.

A client base that can see

There’s a second revolution hiding in plain sight: transparency. When a slide can be generated in minutes, clients will ask what took all week. When an analysis looks machine-native, they’ll ask which parts were. The demand to prove internal AI use is a test of credibility, but it’s also a forcing function for measurable productivity. Consulting has always sold judgment wrapped in effort. The wrapper is dissolving. That pushes firms to codify more of what used to be artisanal—repeatable libraries of workflows, model catalogs, evidence trails—so that the human premium is clearly for judgment, not for keystrokes.

The labor market that follows

There are two plausible equilibria. In one, overall demand for advice rises as AI expands the frontier of what can be analyzed, and firms grow while keeping the base slender—an industry that is larger, but staffed with fewer apprentices and more pilots. In the other, clients in-source the new capabilities, pairing off-the-shelf tools with their own operators, and use consultants sparingly for gnarly problems and governance. Both worlds share the same starting point: a choke on entry-level growth and flat wages where they once marched upward annually. The FT’s reporting, echoed by same‑day summaries, doesn’t read like a cycle. It reads like a remodel.

For the readers of this newsletter, the novelty isn’t that AI can build a deck. It’s that one of the economy’s most reliable engines for minting young, broadly capable operators is being reconfigured around the assumption that the deck is already built. The question is no longer whether AI replaces junior labor in consulting. It’s where society wants the training function to live when the market stops subsidizing it. If you’re twenty-two and ambitious, the answer determines not just your first job, but the scaffolding of your career. And if you’re a client, it changes what you’re buying. Less hands. More judgment. Fewer pyramids. More proof.