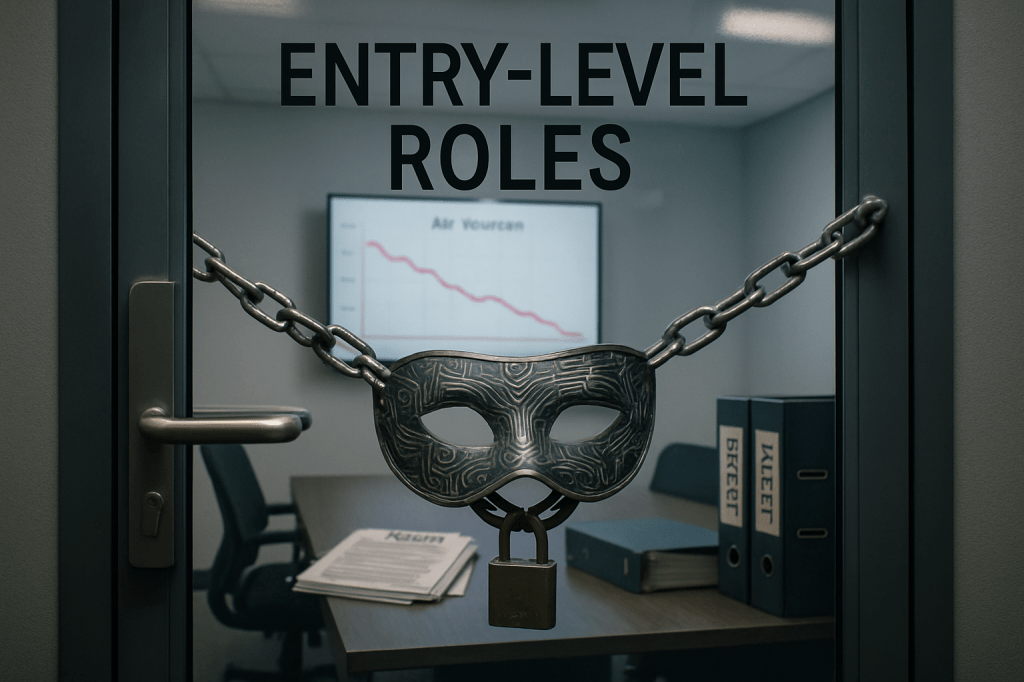

The hiring freeze that wore an AI mask

All year long, the easiest explanation for a young applicant’s unanswered résumé has been the most cinematic: the bots did it. It fits the mood, and it flatters our anxieties. But yesterday’s most important employment story asked us to look away from the shiny object. In Business Insider’s write-up of Dario Perkins’s new analysis, the culprit behind the youth hiring drought isn’t a model in the cloud; it’s the oldest force in labor markets—macroeconomics—wearing a new costume.

Perkins’s case is unsentimental. Since 2023, youth unemployment has ticked up more than two and a half points, yet the sectors most exposed to generative AI aren’t leading the losses. If automation were already scything through entry-level opportunities, we’d expect to see outsize damage where tasks are most model-friendly. We don’t. What we do see is something blunter: a broad-based hiring chill after a post-pandemic binge, piled on top of policy whiplash and tariff-induced margin pressure. Faced with softer demand and murkier forecasts, executives have decided to “sweat” the teams they already have rather than onboard cohorts of rookies. It’s cheaper to stretch a trained analyst than to spin up a new one when revenue is wobbling and the rules of the game keep changing.

The cold-start penalty, not the robot

Entry-level workers always pay a cold-start penalty. They’re costly to train, slow to ramp, and risky when budgets are fragile. Add tariffs that squeeze gross margins, and CFOs rediscover a classic playbook: freeze requisitions, protect cash, avoid commitments that lock in fixed costs. The result looks like tech-enabled displacement from a distance—fewer junior roles, more automation-tinted language in the roles that remain—but up close it’s a cyclical response. That’s why Perkins calls current job creation “recessionary” in feel even without a formal recession. It’s triage, not transformation.

This lens doesn’t deny AI’s fingerprints everywhere inside firms. Tools are diffusing. Workflows are being reworked. Posting language is shifting toward “AI-literate” and “prompt-savvy,” which subtly raises the bar for applicants who haven’t had a first job to learn the new house style. But those are gating effects more than pink slips. The big displacement story requires process redesign to mature and capital to move into new complements. That takes time, and time is exactly what a hiring freeze interrupts.

Two truths that can coexist

It’s also true that some corners are already bruised by AI’s early bite. Goldman Sachs has tracked a roughly three-point rise in unemployment among twenty-something tech workers since early 2024. In highly codified teams where generative systems map cleanly onto task bundles, managers are accelerating a rethink, and junior roles become the first test cases. But what’s happening in those islands is not the weather everywhere. Economy-wide, Perkins argues, the signal still looks cyclical: demand hesitation, policy uncertainty, and costs creeping up at the worst moment for a new grad’s calendar.

Mislabeling the cycle as a robot revolution has consequences. If we decide the problem is automation, we’ll prescribe training pipelines and social insurance while leaving the engine room untouched. If the problem, today, is an aggregate hiring pause, the near-term fix is to declutter the policy outlook, reduce margin stress where tariffs bite hardest, and give managers permission—via demand—to take bets on raw talent again. The long-term AI transition planning remains essential, but conflating the two timelines is like treating a sprain with surgery.

What to watch next

The test of this thesis will arrive in small behavioral shifts. When uncertainty eases, vacancy postings should rise first, followed by a thaw in offers for roles with longer ramp times. The quits rate, temporary help employment, and the vacancy-to-unemployment ratio will tell us if firms are moving from sweating to staffing. If youth unemployment retreats as those dials improve without a slowdown in AI adoption, Perkins’s framing wins the round. If, instead, high–AI-exposure sectors begin to diverge sharply as models become embedded in core processes, we’ll know the second, automation-led act has taken the stage.

For readers of this blog—who live with the hum of disruption—it’s tempting to attribute every labor-market tremor to the same seismic source. Yesterday’s analysis reminds us that AI is a powerful force arriving on a human calendar. Right now, the obstacle in front of new workers is less a machine replacing them than a manager delaying them. When the macro lights turn green, the door should open—only then will we see how far the automation story really runs.