Wall Street Quietly Set the Timeline for White‑Collar Reductions

Onstage in New York, the euphemisms thinned out. At the Goldman Sachs Financial Services Conference, the largest U.S. banks did not talk about pilots or potential. They talked about throughput. They talked about measured gains. And—without bluster—they connected those gains to staffing.

JPMorgan’s Marianne Lake put a number on it: productivity growth at the firm has doubled to 6% from 3%, with operations specialists forecast to see 40% to 50% improvements as generative AI scales across workflows. Citigroup’s incoming CFO, Gonzalo Luchetti, added a concrete datapoint from the software trenches: a 9% lift in coding productivity, alongside customer service tools that enable more self‑service and more effective live‑agent assist. Wells Fargo’s Charlie Scharf was explicit about phasing: no reductions yet, but the organization is now “getting a lot more done” and will “do more with less people” where tasks are restructured. PNC’s Bill Demchak offered the longer arc: headcount roughly flat over a decade while the bank tripled in size—first with automation, now with AI as accelerant. Goldman Sachs had already telegraphed a hiring slowdown under “OneGS 3.0,” and Bank of America is spending billions to lift banker productivity and revenue. Together, the remarks formed a single narrative: AI is out of the lab and into enterprise staffing models.

The compounding that changes budgets

A shift from 3% to 6% productivity growth sounds incremental until you run it forward. Over five years, 3% compounds to roughly 16% more output per employee; 6% compounds to about 34%. If demand is flat, that delta is headcount. If demand grows, the same workforce covers more volume with better service levels. In either scenario, the planning conversation changes from “if” to “how fast.” Lake hinted at a softer landing—higher productivity can reduce the net job impact—yet the direction is unmistakable when operations roles are posting 40% to 50% gains and coding teams are clearing 9% more work per cycle.

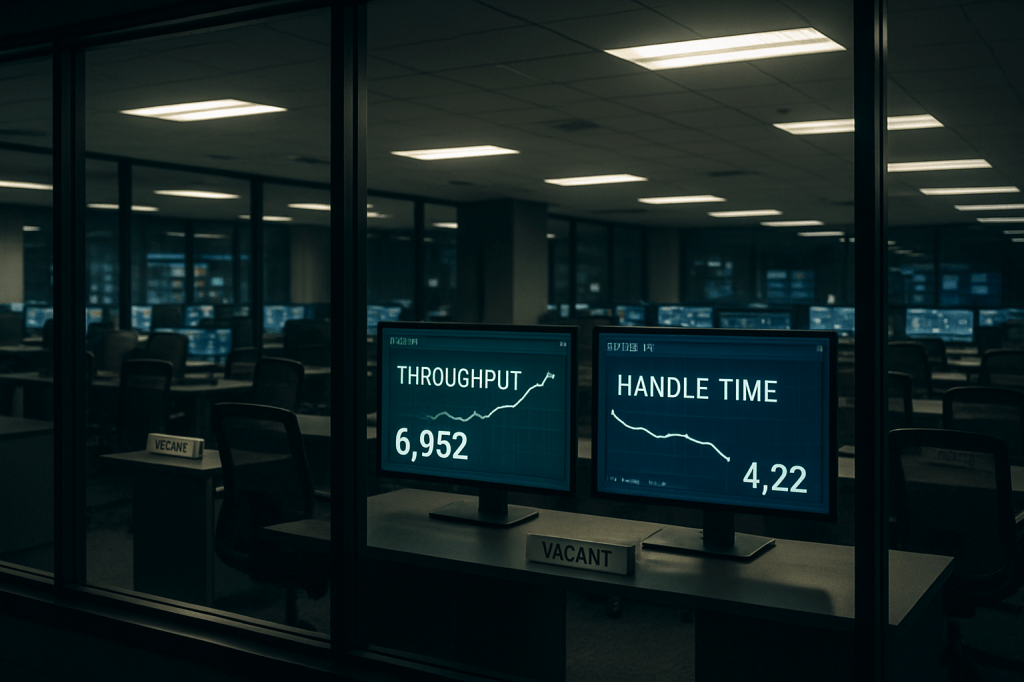

Not robots, workflows

The banks did not frame this as whole‑job replacement. They described task reassembly. Customer calls are shorter because assistants surface context and next steps without a human digging through screens. Compliance checks, reconciliations, and routine ops move from manual sequences to supervised automation. Developers spend less time on boilerplate and remediation. These are not headline‑grabbing humanoids; they’re quiet throughput multipliers, stitched into existing systems and measured by queue length, handle time, and defects per thousand lines of code. That’s precisely why the impact is durable: it lives in the plumbing of the business.

Why banks are the bellwether

Banking is a process industry disguised as a relationship business. It runs on forms, documents, exceptions, and conversations—work that is both abundant and codifiable. When such firms report live gains, the signal usually travels. Insurance shares the same substrate. Healthcare administration isn’t far behind. The banks’ comments mark the point where leaders stop treating gen‑AI as a speculative cost center and start treating it as a lever in the operating plan.

How reductions actually happen

For readers expecting sudden layoffs, that’s not the most likely first move. Wells Fargo said it hasn’t cut yet. More common is a choreography of attrition, backfills that never open, and hiring plans that shrink a percentage point at a time. PNC’s decade of flat headcount alongside massive growth is the blueprint: scale the balance sheet, let automation absorb the extra work, avoid the political cost of explicit cuts until the denominator quietly changes what “fully staffed” means.

Still, the message yesterday moved beyond subtlety. When multiple systemically important employers publicly bind measured productivity gains to the ability to run leaner operations and contact centers, HR, finance, and line leaders gain permission to translate throughput into org charts. It becomes acceptable to say, “We can meet next year’s volume with fewer specialists,” and to fund the software accordingly.

The new bargaining position of white‑collar work

Operations specialists, customer support agents, and internal tech teams are the immediate exposure. The fact pattern points to role redesign—fewer low‑variance tasks, more exception handling and oversight—but redesigned roles rarely preserve prior staffing levels when the machine handles the median case. The workers who stay will supervise flows, not just execute steps, which will raise the skill bar for the remaining seats and ratchet compensation toward those who can instrument, monitor, and course‑correct the systems.

A balance sheet view of AI

There’s also a capital markets angle. Productivity improvements of this magnitude do not just hit expense lines; they expand the feasible frontier of service. Faster onboarding, cleaner compliance, and higher first‑contact resolution can attract and retain customers. Executives will frame the headcount effect as a byproduct of pursuing better economics, not the goal itself. But in budgeting season, “the byproduct” turns into a number.

The signal that matters

We’ve had demos for two years. Yesterday we got operating data with headcount implications attached to it, on the record, from the employers who influence white‑collar norms. If you’re inside a large organization, expect three near‑term markers: fewer requisitions for roles heavy on routine work, more internal training on AI‑assisted tools tied to individual performance targets, and a redefinition of “capacity” that assumes assistance is on for everyone. The technology moment passed months ago; this was the governance moment.

Bottom line: Wall Street’s largest banks just collapsed the debate. AI is not merely helpful—it is now productive enough, measured enough, and trusted enough to change staffing math in core back‑office and customer‑facing functions. The displacement pressure has moved from theory to planning, and the plan has already started to run.