2025’s Tech Layoffs Read Like an Org Chart Being Recompiled

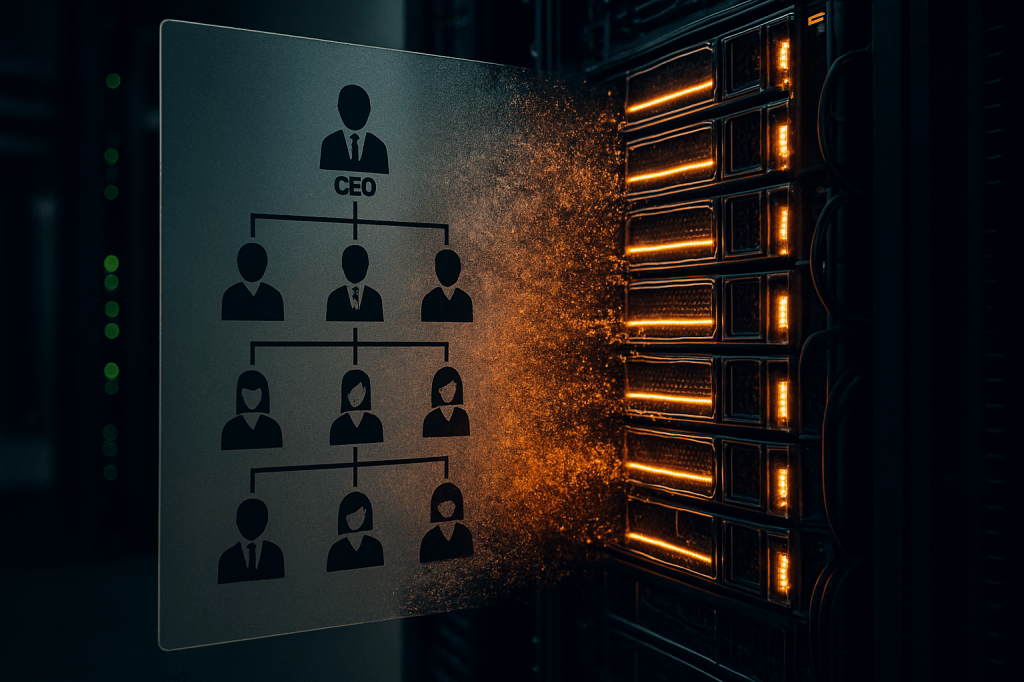

Year-end roundups usually feel like accounting. This one didn’t. Moneycontrol’s tally of 2025’s biggest tech job cuts wasn’t a postmortem on a soft quarter; it read like a blueprint for the next operating model. More than 120,000 roles vanished across the industry, and the connective tissue wasn’t just cost discipline. The through-line was AI as a first-order driver, pushing companies to rewire the way work happens. The headline wasn’t “belt-tightening.” It was “structural reset.”

Look at where the blade fell and what it financed. Intel’s roughly 24,000 cuts arrived alongside a foundry-first pivot that demands capital-hungry fabs tailored for AI-era chips. TCS trimmed about 20,000 as its traditional delivery engine gave way to AI-led service models that prize automation-first workflows over bench strength. Amazon’s ~14,000 focused on flattening management as the company retools around AI-native products and logistics. Dell moved around 12,000 while leaning into AI-optimized hardware and services. Accenture reconfigured around generative-AI consulting. SAP reorganized around business AI and cloud. Microsoft reallocated headcount into cloud and AI infrastructure. Cisco redirected spend to cybersecurity and AI. Even outside the software core, Verizon and Toshiba reshaped their structures. Different logos, same gravity well.

The common pattern isn’t mysterious: layers built for an era of manual coordination are being stripped away, and budgets are being pulled forward into platforms. Management tiers thin out because orchestration is increasingly encoded in systems. Legacy delivery roles shrink because AI-infused pipelines move requirements capture, testing, documentation, and operations into tools that don’t ask for weekly status meetings. Capital expenditures tilt toward data centers, accelerators, and the software scaffolding that lets smaller teams do what used to take entire departments.

That’s why the cuts spanned chipmakers, IT services, cloud platforms, device vendors, and telecom. This isn’t one niche shedding weight; it’s a shared response to the same technical constraint: the returns to scale now live in AI infrastructure and automation, not in headcount-heavy coordination. Read the rationales side by side and you get a labor-market signal that’s unusually clear. The roles most exposed sit in the middle—where translation, tracking, and repetitive integration used to live. The roles most insulated sit at the edges: building AI platforms, expanding cloud capacity, securing the new stack, and standing up data-center muscle.

None of this means companies are shrinking their ambitions. They’re changing the shape of effort. An AI-led delivery model prizes systems that are deterministic about process and probabilistic about output, which in practice means fewer generalist intermediaries and more specialized builders tending to the machines that tend to the workflows. The uncomfortable part is the timing mismatch: reductions are immediate and visible; new hiring is selective and quiet, concentrated in teams that don’t advertise headcount the way a mass layoff does.

The question for 2026 isn’t whether AI continues to drive reorganization—it will—but whether the industry reaches a stable equilibrium or runs another pass of refactoring as AI-native products and internal automation mature. Watch where the bodies land: administrative layers and legacy delivery cohorts will likely keep thinning, while AI platform groups, cloud and data-center buildouts, and security teams continue to absorb investment. If 2025 was the year the org chart snapped into a new shape, 2026 will show whether that shape holds.

By stitching together the year’s largest cuts and saying the quiet part out loud—that these were AI-led transformations, not just bad weather—Moneycontrol’s roundup captured the turning point. It’s not a pause in hiring; it’s a reallocation of agency, from people who coordinate processes to systems that encode them. The market is voting with headcount, and the ballot is written in GPUs, cloud capacity, and teams that make them sing.