When “AI” Became a Layoff Reason Code

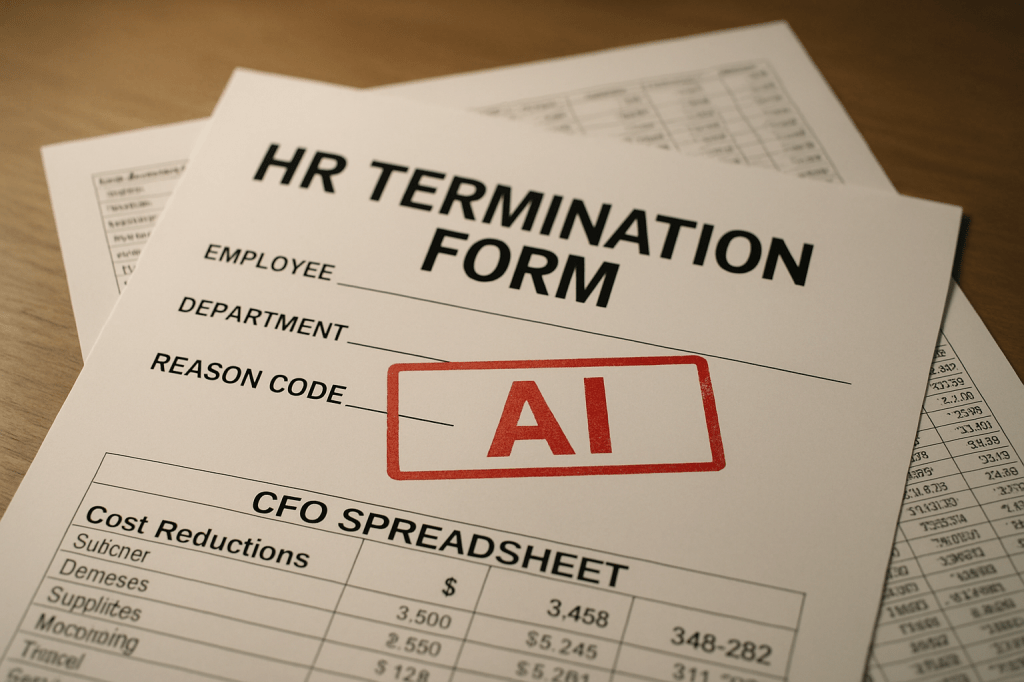

Yesterday the number stopped being a rumor and became a line item. U.S. employers have now explicitly tied nearly 55,000 planned job cuts this year to artificial intelligence. Not whispers in an earnings call, not an anecdote about a clever bot shaving minutes off a workflow—an actual reason code in the layoff ledger. Challenger, Gray & Christmas, the firm that has been tallying restructurings and closures for decades, recorded “AI” at a scale they’ve never seen. With it, total planned cuts climbed to roughly 1.17 million, the most since 2020. The story isn’t that companies found a new euphemism. It’s that AI finally graduated from demo day to headcount math.

From productivity theater to P&L

For two years, executives pitched generative AI as the force multiplier that would let teams “do more with less.” In 2025, “less” stopped being theoretical. The CFO’s spreadsheet absorbed the promise and produced a cost line. What changed was not just capability but accountability: as models mature, finance leaders are asking for measurable return, and HR is being asked to articulate the operational consequence. That’s how a software category becomes an HR category. When a CEO can point to AI agents taking tickets off a support queue, “AI” moves from a morale-boosting slide to a rationale for workforce redesign.

What the ledger actually says

Challenger’s November snapshot shows 71,321 planned cuts that month—down sharply from October—with 6,280 attributed to AI. Year to date through November, companies had publicly tied 54,694 planned cuts to AI, and 71,683 since firms began citing it in 2023. These are announced reductions, not instantaneous unemployment; some won’t materialize one-for-one, and timing can lag. The category isn’t swallowing the economy, either. Restructurings, closings, market conditions, tariffs, and government downsizing still dominate the reasons column. But the presence of an “AI” line at this magnitude changes the conversation because it assigns causality where, until now, companies preferred ambiguity.

Who said the quiet part out loud

This isn’t confined to obscure firms hunting headlines. Microsoft, Amazon, IBM, and especially Salesforce have been explicit: AI is reshaping how they staff. Salesforce’s chief executive offered a concrete example—AI agents cut global customer-support headcount by around 4,000 this year, from roughly 9,000 to about 5,000, with some people redeployed. That is the operational signature of this wave: it doesn’t obliterate whole companies; it pinches specific job families where tasks can be routinized and instrumented. Customer support, parts of recruiting and HR operations, software QA, and routine analysis are early proving grounds because their outputs are measurable, their workflows are scripted, and their risk tolerances can be tuned.

For investors, the messaging is deliberate: tying reductions to AI frames cuts as modernization rather than just belt-tightening. For employees, it removes the euphemisms. If a system does the work, the decision is no longer a “realignment.” It is a substitution.

The odd calm of “no fire, no hire”

Zoom out, and the labor market is sending mixed signals. Planned cuts through November are up 54% from last year, yet initial jobless claims haven’t surged. Hiring plans are historically weak, the lowest since 2010, creating a “no fire, no hire” equilibrium: fewer backfills, more attrition, and slower movement rather than visible mass unemployment spikes. AI’s early impact is concentrated in entry-level roles, the exact tier that usually absorbs new graduates and career switchers. The churn doesn’t look like a tidal wave of joblessness; it looks like doors failing to open.

The missing first rung

This is the deeper risk that yesterday’s number spotlights. Entry-level roles are more than a labor expense: they are apprenticeship systems. Support reps become implementation specialists. Recruiting coordinators become talent partners. QA analysts become SREs. If AI absorbs the repetitive tasks that previously justified those junior roles, the pathway narrows. Companies will still need judgment, escalation handling, and oversight—but those skills are usually cultured through doing the “low” work first. Without that first rung, you don’t get the middle. Over time, that can produce a brittle workforce: senior-heavy, tool-dependent, and difficult to replenish.

Education providers will feel it next. Bootcamps and colleges sell their proximity to the first job. If that job morphs into tool-orchestration with fewer seats and higher bars, “job-ready” will require different proof. Expect more assessments that simulate agent supervision, prompt design for complex edge cases, and human-in-the-loop risk handling. Expect, too, a premium on domains where AI is helpful but not sovereign: regulated customer interactions, trust-sensitive decisions, and messy operational work that resists templating.

Counting what gets named

It’s worth underlining how the number is constructed. Challenger counts what companies say. If a firm cites “restructuring,” the layoff doesn’t hit the AI column, even if AI made the restructuring feasible. If a firm says “AI,” it does. That makes the 55,000 both conservative and political. Some executives avoid the label to dodge backlash or regulator attention. Others embrace it to signal efficiency to markets. Either way, the language itself is part of the story: in 2025, enough leaders felt confident—or compelled—to attach AI to workforce reductions in formal communications. That’s a cultural shift as much as an operational one.

What to watch in 2026

If 2025 was the year AI entered the HR lexicon, 2026 will test whether the savings compound or stall. Three markers matter. First, the mix: do AI-attributed cuts remain concentrated in repetitive-service roles, or creep into mid-skill operational work as agentic systems handle more exceptions? Second, the pipeline: do companies rebuild entry-level pathways as “agent supervisors” and “workflow governors,” or do they hope the market supplies mid-level talent without training? Third, the accounting: do firms standardize how they attribute productivity gains and headcount reductions to AI, or does the category become a catch-all for any efficiency program with a chatbot attached?

The macro backdrop will shape the narrative. If growth slows, AI becomes a shield for austerity. If growth holds, AI becomes the justification for leaner teams and slower hiring, the invisible tax on opportunity. Either way, the experiment has moved from pilot to policy.

The line that can’t be erased

Fifty-five thousand planned cuts is not an economy-ending number. But it is a boundary line. Before this year, automation stories were mostly about tools. After yesterday, they are also about people—and not in the abstract. AI is now a stated reason in the file folder handed to HR, a term that appears in the same breath as “closing” and “market conditions.” The novelty isn’t that software replaces tasks. The novelty is that leaders are finally recording it as the reason people leave. That admission unlocks a harder conversation: how to keep building skills, careers, and companies when the first draft of work belongs to a machine.