Europe’s Banks Put a Price on the Middle: 200,000 Jobs by 2030

Yesterday, the abstraction finally acquired a number. For years, European banks have promised that AI would smooth out the frictions in back offices and lighten the load in compliance. On January 2, Morgan Stanley turned that promise into arithmetic: roughly a tenth of the sector’s workforce—about 200,000 to 212,000 people—could be gone by 2030. It’s the kind of figure that stops arguments mid-sentence. AI in finance is no longer a glide path; it’s a headcount plan.

From talk to totals

The projection covers 35 European lenders employing around 2.12 million people and points squarely at “central services”—operations, risk, and compliance—where banks say automation can deliver efficiency gains up to 30 percent. Branch closures remain the second engine, grinding on as customers move online and regulators tolerate smaller physical footprints. The analysis didn’t emerge in a vacuum: ABN Amro has already signaled a 20 percent headcount reduction by 2028, Société Générale’s leadership talks in sweeping terms about redesign, and a JPMorgan executive has voiced the worry many insiders share—that aggressive automation can erode the very training grounds that built the industry’s competence.

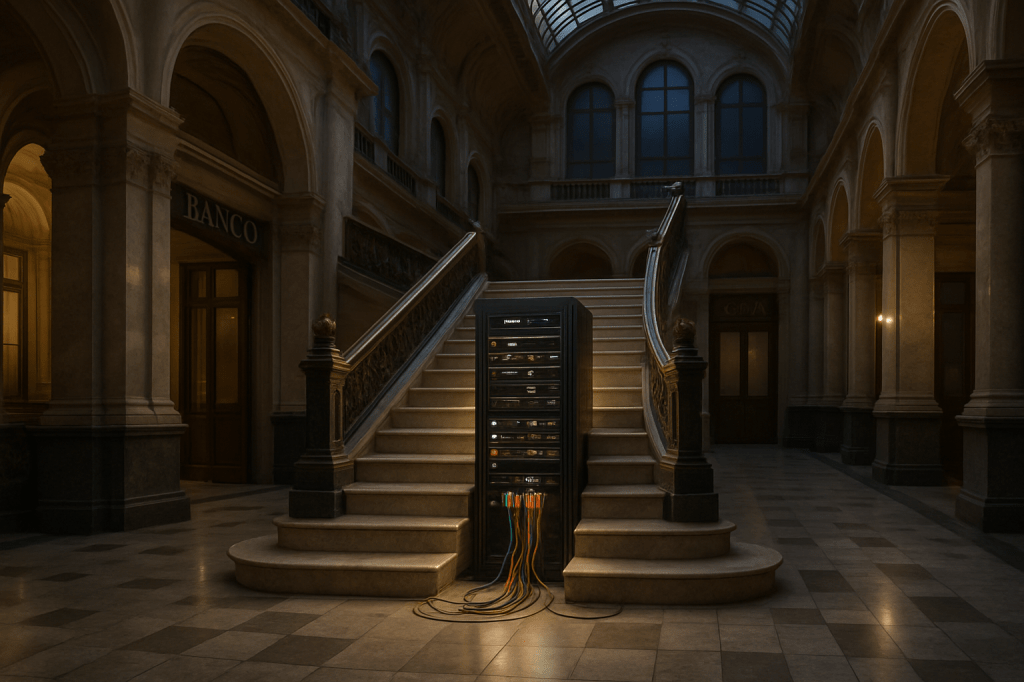

The disappearing staircase

The roles in the crosshairs are not glamorous, but they have been formative. Operations, reconciliations, documentation reviews, KYC and AML, control testing—these are where juniors learn how the plumbing works, where they discover what can leak and why. Compress those layers with AI and related software, and you don’t just lower costs; you flatten the apprenticeship ladder. Even if front-office numbers hold, the internal circulation that once promoted analysts into risk-savvy decision makers thins out. When machines do the repetitive work perfectly, the organization loses the safe place where humans once learned to do it imperfectly but thoughtfully.

A structural shift, not a winter

This isn’t a cyclical pruning dressed up as innovation. European banks are chasing better cost-to-income ratios and return on equity to shrink the gap with U.S. peers, and automation of central services is the lever that still moves. Branch networks keep shrinking because customer habits made that decision years ago; AI just makes it economically irresistible. Consumer-focused lenders in large markets, notably France and Germany, look especially exposed. Expect attrition and redeployments to carry the narrative, but the direction is set: fewer people doing more oversight through software, with shared-services footprints under review.

The control paradox

Risk and compliance are being reimagined with the very tools they are meant to police. Automated monitoring, document parsing, and model-driven reporting promise speed and consistency, but they also concentrate failure modes and invite new kinds of blind spots. Thin the headcount in regulator-facing functions too quickly and the institution’s memory degrades just as model-risk management becomes more intricate. Supervisors will notice. Guidance on model controls, operational resilience, and AI documentation standards is likely to tighten as banks push more complex systems into production while promising fewer people to watch them.

Local shocks in a gradual story

Sector-wide, a one-tenth reduction spread over four years sounds manageable. Labor markets can absorb retirements and redeployments; software doesn’t strike. But the averages disguise geographic pressure points. Cuts to central services tend to cluster in specific hubs, and branch reductions are felt neighborhood by neighborhood. If shared-services consolidation and hiring freezes land unevenly, some towns will discover that the “back office” was, in fact, their main office.

What moves next

Watch how “efficiency gains” get translated into investor slides and staffing maps. Cost-to-income targets have a way of turning abstractions into deadlines. Keep an eye on whether banks concentrate reductions in particular hubs and how they describe reskilling for control functions. Regulators will signal their tolerance through guidance on model governance and resilience; any hint of supervisory unease will ripple quickly through boardrooms. Labor groups and national policymakers will test the political boundaries of branch shrinkage and AI-enabled consolidation, especially if the junior pipeline becomes a public conversation rather than an internal worry.

The wager

European banking is placing a long bet that software can shoulder routine judgment without corroding the well of human judgment behind it. The winners will pair automation with a new training architecture, rebuilding the staircase in different materials—simulation-heavy curricula, rotation through model validation, hands-on supervisory engagement—so that people still learn how the system fails. The laggards will discover that cheaper processing can be expensive when controls snap under the weight of their own opacity.

January 2 was the day AI’s impact on European finance received a concrete denominator. Two hundred thousand is not a forecast of panic; it’s a calendar for change. The industry has chosen its direction. The story from here is whether it can keep its competence as it sheds its steps.