AI Layoffs Are the New Alibi

Somewhere between the third slide of an earnings deck and the muted Q&A, a familiar line appears: we’re streamlining with AI. It is a tidy sentence that promises discipline without guilt, innovation without proof. Yesterday’s briefing from Oxford Economics, relayed by Fortune, quietly pulled at that thread. If companies are truly replacing people with machines at scale, the economy should be leaving footprints. Instead, the data look like sand—shifting, cyclical, and stubbornly human.

The headline fear has been clear for a year: wave after wave of “AI-related layoffs.” But when you step back from the press release and into the numbers, the story changes shape. In the first eleven months of 2025, companies explicitly blamed AI for nearly 55,000 U.S. job cuts—roughly 4.5% of announced layoffs. Far more were pinned on ordinary economic conditions, about 245,000 by Fortune’s count, and that’s before you remember the labor market churns through 1.5 to 1.8 million separations every month. In that context, the supposed tide of AI-driven displacement looks more like a ripple catching the light.

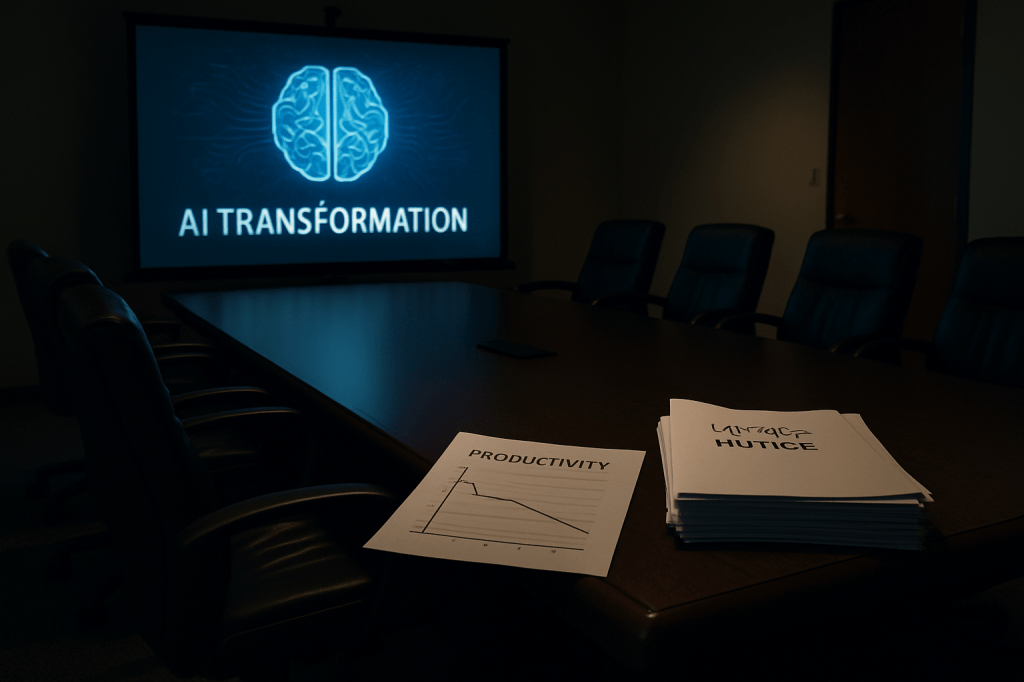

The more telling absence sits in productivity. If software were already eating substantial swaths of white-collar work, output per worker should be breaking out of its long plateau. Oxford Economics points out it isn’t. We can argue about measurement lag and the classic productivity paradox, but a true automation shock leaves a trail. This one, so far, reads like a routine correction dressed in futuristic language.

Why reach for the AI label at all? Because it flatters. “We over-hired and demand softened” is the managerial equivalent of eating your vegetables on camera. “We’re reallocating to AI” sounds like a bet on the frontier. As Wharton’s Peter Cappelli notes, many announcements lean on the future tense—AI will cover this work—an admission that the substitution is more aspiration than operational reality. Investor-relations wants a north star; cost-cutting wants cover. AI, conveniently, offers both.

Even the gloom around junior roles fits this pattern. Graduate unemployment ticked up last year, but Oxford sees more evidence of a cyclical glut than a vacuum created by chatbots. Fortune situates this in a broader drift toward a low-hire, low-fire equilibrium—a “jobless expansion” where output can inch forward without headcount snapping back. That’s not software displacing salaried workers so much as managers sitting on their hands, letting attrition do quiet work while they wait for revenue to justify risk.

For boards, this is an uncomfortable mirror. Announcing an AI pivot is easy; delivering its dividends is not. You can’t conjure productivity by press release. Without the unglamorous plumbing—clean data, re-engineered processes, clear guardrails, redesigned roles—headcount cuts are just headcount cuts, and the credibility gap widens when the promised efficiency fails to materialize. Treat the word “AI” like you would “profit”: only say it when you can show it.

For workers, the takeaway is subtler than the headlines suggest. The near-term risk remains concentrated in familiar forces: demand wobbles, budget freezes, projects deferred. AI is absolutely threading itself into workflows, but the displacement arriving now is incremental, not cliff-like. Plan for a world where your job’s shape changes quarter by quarter—less keystroke production, more orchestration and judgment—rather than vanishing overnight. The real warning sign isn’t a viral memo; it’s when your team’s throughput spikes without overtime because the process itself got rewritten around machines.

For investors, this is a filter. Don’t confuse theater with transformation. Watch whether companies that cite AI in restructuring also post sustained gains in output per employee, improved unit economics, faster cycle times, and a reshaped hiring mix that tilts toward machine-facing roles. If the headcount shrinks but cloud bills, integration contracts, and model-ops staffing don’t rise—or if service levels slip—you’re looking at branding, not automation.

None of this means the story ends in denial. Fiction today doesn’t prevent fact tomorrow. The second act begins when firms finish the boring work: standardizing data, codifying workflows granular enough for machines, hardening legal and security frameworks, and putting real money into the systems that turn prompts into profit. When that arrives, you won’t need a press release to notice; the productivity line will move first.

How to Read the Next “AI Layoff” Announcement

Start with the verbs. If the language leans on “will,” “plan,” and “expect,” you’re hearing a futures market, not cash in hand. Look for present-tense evidence: what tasks are already automated, what throughput has already improved, what error rates have already fallen, and what capital has already been deployed to make it stick. Ask how roles are being redesigned, not just reduced, and whether the company is hiring into the hard parts—data engineering, integration, governance—that enable durable substitution. If all you see is a smaller payroll and a larger promise, assume you’re being asked to believe a timeline, not a transformation.

In an age allegedly defined by machine efficiency, the most aggressively automated asset so far might be the corporate narrative. Until the numbers follow the words, treat “AI layoffs” as a message about signaling, not a measure of how much work the machines have actually taken.